B2B buying behavior involves multiple stakeholders, evolving buying criteria and an elongated consideration cycle. The sales and marketing tech stack only increases this complexity, so it seems counterintuitive to say B2B companies need another source of data to add to the mix.

Unless such a source introduces an entirely new way of thinking about prospects—a revolutionary avenue to get your solution in front of new accounts that look and act like your best customers.

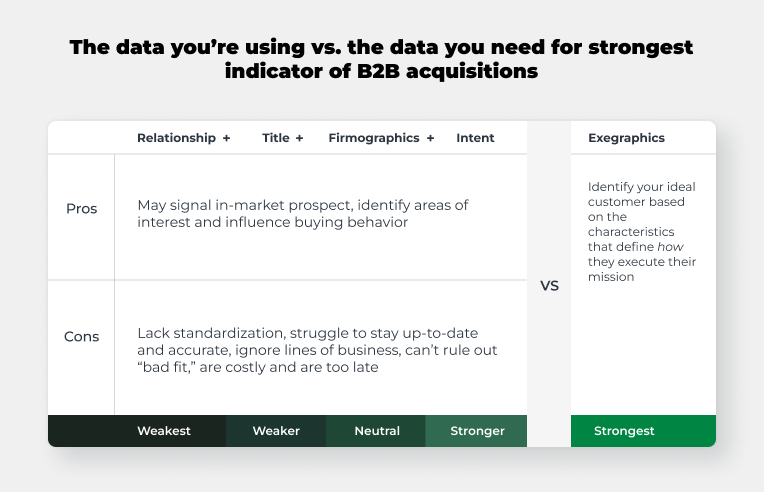

To make the case for a new approach, let’s first look at the B2B data being used today to understand current limitations.

The truth about relationship data

Businesses have relationships with customers and vendors. People have relationships with each other and companies, both as buyers and sellers. People we don’t know but respect influence our behavior, including our buying behavior. What could be more predictive?

Unfortunately, when it comes to relationship data you might as well be throwing darts, blindfolded. Using relationships for targeting is the fuzziest realm of them all. Where’s the scale?

The truth about titles

People are more than their titles. They have varying levels of influence and competence, experience, tenure with their companies and so on. These things matter. Moreover, the meaning of a title depends upon the context—the size of the company, the company’s core activities, the titles of others on the management team.

Additionally, there is no universal standard for what a title means. In the tech sector, “business development” in a title can mean an entry level salesperson qualifying inbound leads and/or prospecting on behalf of other sales people, or it can describe a very senior level executive developing strategic alliances with huge companies. There are many examples like this.

Next, people grant themselves fancy titles to create all manner of perceptions. LinkedIn is famous for this. Self-aggrandizement is a core benefit of a resume database like LinkedIn.

Similarly, banks are notorious for making lots of people a vice president or at least an assistant vice president rather than giving them better compensation. Many companies use this strategy.

As if that weren’t bad enough—and it is—you also have the problem of decay. The dynamics of the marketplace result in people starting new jobs, receiving promotions and being laid off.

The truth about firmographics

Most sales leaders use firmographics (especially employment or revenue) to allocate sales resources and route marketing leads. Sales and marketing rely on this data to identify account based marketing targets. Firmographics as the primary filter eliminate more accounts than all other targeting mechanisms. However, scrutiny of firmographic data from any of the usual suspects in the B2B world reveals much of the information gleaned is out of date and inaccurate.

Why firmographics fail

1. The self-classification problem

The US government and many data compilers and publishers like LinkedIn ask businesses to self-classify. So do most B2B publishers and social media giants. Unfortunately, those who self-classify have no training to make such assignments. Moreover, companies will often make selections based on how they want others to perceive them. This approach is very common with directories, where additional “lines of business” equate to additional opportunities to sell products or services.

2. The innovation problem

The North American Industry Classification System (NAICS) with its thousand-plus six-digit codes, provides the illusion of accuracy, even for well known companies. Industries like the tech sector create business models more rapidly than government bureaucracies can update the classification systems. The NAICS can’t easily accommodate emerging business models, while dynamic industries like the tech sector are often the most lucrative targets for many companies precisely because of this characteristic of innovation.

3. The conflation problem

Those who assign industry codes to a business often confuse what a company does with who they serve. For example, software companies that serve the healthcare industry get classified as healthcare firms rather than as software companies. Of course, it’s useful to know the markets a company serves, but blurring markets served with activity performed is not helpful.

4. The line-of-business problem

Even small businesses diversify their lines of business. IT services firms often build software products, for example. Gas stations have fast food restaurants quite frequently. Car washes sell gas, in many cases. Accounting firms provide consulting, configuration, and management of financial systems, offer human resources services, merger and acquisition services and other lines of business. These scenarios are common, as businesses constantly experiment with different models as a means of appealing to customers, getting a larger share of the wallet and responding to competitive pressures and industry regulations.

5. The degree problem

In each of these cases, the question is not simply whether a company is part of an industry but rather to what degree. For example, if you find that a company needs to target software companies generating at least $20 million in revenue, what do you do with a $50 million company getting part of its revenue from software? You don’t know if 10% or 95% of the revenue is coming from software rather than another line of business. This problem is widespread in the B2B ecosystem.

6. The descriptiveness problem

Despite the seeming granularity of the NAICS system, you can’t distinguish very simple criteria. For example, the code for software publishers, 511210, does not distinguish between firms selling to consumers (like gaming software) and those selling to businesses, or both. You can’t tell the degree to which companies sell products rather than services. You also can’t tell where in the supply chain the revenue comes from. For example, to what degree does the company warehouse and pick, pack and ship its products, use ecommerce, indirect channels, retail outlets, and/or direct sales via field or inside reps? These characteristics are simply unavailable in industry codes.

The truth about intent

To be sure, intent data should be one of many signals marketers use to identify when companies are in-market. Other signals might include a job posting, a leadership change, a round of funding, new legislation, good or bad press, just to name a few.

Intent data you already use

If you have a marketing automation platform, like Marketo, Oracle Eloqua, HubSpot or Pardot, then you are probably using intent data. Intent data can include the email opens and clicks of your customers and prospects, the pages your customers visit on your website, the webinars they register for and attend, the e-books they download, their social likes and shares, and similar behavioral activity. You are using this intent data, among other things, as an input to your lead scoring model.

Third-party intent data you can buy

Third-party intent data vendors have arrangements with numerous B2B publisher sites to license this same behavioral data on those sites, including page views, email opens, white paper downloads, site search strings and so on. You can select a topic area and get that data at the account/domain level, not the contact level. The basic idea is that, if an account is more active around a topic, chances are they are in-market for the solution. Sounds reasonable, but it’s still a guessing game. An expensive one.

Search data is another type of intent data. Google Ads lets you bid for clicks, one search at a time. The Google Ads advantage is speed and relevance. As soon as someone enters a search string, advertisements can pop up. And those ads are specific to the keywords used in the search.

Unlike third-party intent data vendors, Google tries to tailor the search to the individual typing in the search string. Marketers can try to gain first page ranking through search engine optimization or pay for clicks through Google Ads, Bing Ads or other paid features in search engines.

The weakness of Google Ads in search is that you must bid for top positioning, and it’s pretty expensive, especially when you do the downstream math. Just multiply the cost per click by the small percentage of people who fill out your lead form and multiply that number by the small number of people who convert into a customer. Acquisition costs are hefty. That’s OK if you’re selling a solution with a $100k+ lifetime value. It’s not so great for most B2B scenarios.

The problem(s) with intent

Intent data can be a helpful input for inbound marketing efforts, but it still doesn’t tell you the full story or help you with your outbound sales strategies. Here’s what you need to keep in mind.

Problem #1: Bad fit

None of the intent data vendors or the publishers, social media companies or search engine companies want you to ask yourself whether the people and the companies they work for are a good fit for your product or service. Let’s say someone really is in the market for a solution. Does that mean your solution is the right one for that individual? Of course not. If you are marketing an enterprise CRM, for example, and you reach a small business who needs a simple CRM, chances are there is not a good fit between the intent and your solution. In that case, your enterprise CRM sales person will likely waste time talking to that prospect. Worse, the sales person might convince the small business owner to buy the enterprise solution. Before long, you have a very unhappy and possibly unprofitable customer, one who is posting negative comments on social forums and review sites and consuming lots of sales and support time.

Problem #2: Decay

Intent data has a short shelf life. If you don’t act on that behavior quickly, you’ll often lose the opportunity to do so.

Google has built a $95B search business by understanding the need for speed. You do a search. You see results in sub-seconds. You don’t come back in a few minutes, a few hours, tomorrow or next week. If that were the case, Google would probably be a small company.

That’s the first big problem with third-party intent data. The lack of immediacy. Do you know what blog posts or articles you read last week? Referencing something a prospect came across a week ago (or longer) is not likely to be effective.

Still, intent data can help you figure out areas of interest so you can be more relevant in future interactions. In theory, intent data can potentially reveal depth of interest, helping you with lead scoring. However, interests change. And fast.

Problem #3: Invisibility of individuals

Unlike Google, intent data vendors don’t tell you who the person or people are who have interest in the topic. Instead, you just know the account has an interest. Now, knowing the account has value, but not nearly the value it would have if you knew who the people were that a topic is engaging. You are left with reaching out to people who may not have expressed the interest at the account.

Problem #4: No intention

First, not all content within a topic has predictive value. You’ve probably read about lots of topics and never purchased anything related.

Problem #5: No influence or authority

IBM has about 280k employees. Most of them, no matter what they read, have absolutely no influence on any purchase above $5k. The bigger the purchase, the lower the number of people at IBM who get to vote on what IBM buys.

Traditional media, social media, search engines and demand-side platform companies often don’t want you to spend much time thinking about that reality, but you should. You’re paying to reach that audience, regardless of whether they influence the purchase of your product.

Problem #6: Late to the party

For many products and services, it’s crucial to talk to the customer early enough to help shape the buying vision. Get in too late, and you are often responding to an RFP your competitor helped craft, one that highlights your weaknesses relative to areas of advantage for your competitor. Obviously, there is intent. You just got there too late.

All these problems with intent data should not give you the idea that intent data has no value. It does, but it is only one type of signal in an ocean of signals that lets you know which companies are in-market and a good fit. It makes sense, then, to use a broad set of signals, not just one.

B2B data re-imagined: Using exegraphic data

Data, to be effective in driving sales, must not be a snapshot in time but a network of ever-changing people, ideas and companies. Mere firmographic models are too inaccurate and simplistic.

AI can predict who will buy, their buying capacity and buying longevity, not just who will respond. It can paint you a picture of how your prospect executes their mission: Are they hiring/growing a certain way? Do they have early adopters on their team? What real-time changes does the data reveal? The right data enables identification of your ideal customers above the funnel—before they’ve shown intent. The data you need is called exegraphic data, and it’s your solution to chasing down the wrong leads at the wrong time.

In short, exegraphics make everyone on your team smarter, faster, by providing access to the deep signals that reveal what makes your best customers your best—so you can find others that look and act just like them. An AI-driven B2B marketing system with no complicated tech stack integrations saves time, money and effort moving your customers through your sales funnel.

Make your investment in AI count by using the right data. Get a demo.