Have you ever lost a big sales opportunity without knowing why it slipped away? If so, you’re not alone. And there’s good news. Those lost sales opportunities can actually be great learning experiences if you take the time to conduct a win/loss analysis.

In fact, by understanding lost opportunity trends, you can:

- Develop better sales strategies

- Improve customer service initiatives

- Create more effective marketing and sales messaging

- Adjust pricing to ensure a competitive advantage

- Analyze competitor activity and adjust accordingly

In this post, we’ll explore what a win/loss analysis is, how to calculate your win/loss ratio and how you can use this strategy to improve your sales process. We’ll also share seven tips to prevent losing sales so that you can increase your overall win rate.

Let’s get started.

What’s a win/loss analysis?

Win-loss analysis (also called lost sales analysis) systematically identifies patterns in lost sales opportunities. This type of analysis aims to identify lost opportunities, understand why they were lost and take actionable steps to prevent lost sales in the future.

What’s the benefit of conducting a win/loss analysis?

Regularly conducting a win/loss analysis can give you insight into every lost sales opportunity by examining the reasons behind lost interactions and uncovering hidden trends. This helps you identify any weaknesses in your sales funnel, product features, customer service, pricing structure and more. From there, you can use this data to create better strategies for winning business.

For example, maybe lost deals were due to competitive pricing or an inability to deliver on key customer demands. With this information, your sales team can make necessary changes to their sales approach to better address customer needs or out-maneuver the competition.

How to conduct a win/loss analysis

Conducting a B2B win/loss analysis involves systematically gathering and analyzing data about the factors that contributed to your company’s success or failure in a sales opportunity.

Here’s a step-by-step framework to help you conduct a B2B win/loss analysis.

Step 1: Define the objectives

Identify the objectives of the analysis, which could include understanding customer needs, assessing sales strategies, evaluating competitor performance, identifying market trends and improving product development.

Step 2: Identify the participants

Determine who will participate in the analysis, which could include sales reps, customers, decision-makers, stakeholders and others who have significant involvement in the sales opportunity.

For example, you might involve sales reps who were directly involved in the sales opportunity, customers who participated in the sales process, decision-makers who were involved in the purchase decision and stakeholders who have insights into the industry.

Step 3: Collect data

Collect relevant data by conducting interviews, surveys, and reviews of sales records and other documentation. The data should cover the entire sales cycle, from lead generation to closing or losing the deal.

For example, you can interview sales reps, customers and decision-makers to understand their perspectives. You can also collect sales records and other relevant documentation to supplement the interviews.

Step 4: Analyze the data

Analyze the collected data to identify the key factors contributing to the win or loss, such as product features, pricing, customer service, sales pitch, competitor analysis and market trends.

Step 5: Identify the key takeaways

Based on the data analysis, identify the key takeaways, such as what worked and what didn’t, customer preferences, common objections, competitive advantages and areas for improvement.

Step 6: Develop action items

Develop action items based on the key takeaways, such as improving product features, pricing, customer service, sales training and market positioning.

Step 7: Implement changes

Implement the action items by making the necessary changes to your sales strategy, product development and customer service.

Step 8: Monitor and evaluate

Monitor and evaluate the impact of the changes on your sales performance and customer satisfaction. Continuously refine your sales strategy based on the feedback from your customers and sales reps.

Step 9: Share insights

Share the insights and recommendations with the relevant stakeholders, including the sales team, product development team, customer service team and management. This will ensure that everyone is aware of the findings and can take action based on the recommendations.

Win/loss ratio formula

The win/loss ratio is a simple formula to measure a company’s success rate in winning business opportunities. The formula is:

- Win/Loss Ratio = Total Number of Wins / Total Number of Losses

For example, if a company won 20 deals and lost 10 deals, their win/loss ratio would be 2:1.

Knowing the win/loss ratio is important because it provides a quick and easy way to assess your team’s success rate in winning business opportunities. By tracking the ratio over time, your sales team can identify trends and patterns in their sales performance and take action to improve their sales strategies and tactics.

In addition, understanding the win/loss ratio can help sales reps identify areas where they are excelling and areas where they need to improve. For example, if your team has a high win/loss ratio, they may be doing an excellent job of targeting the right prospects and delivering a compelling value proposition.

On the other hand, if your team has a low win/loss ratio, they may need to reassess their messaging and positioning to improve their chances of winning more deals.

7 tips to prevent losing sales opportunities

Preventing lost sales opportunities requires a combination of research, preparation, relationship-building and excellent customer service.

Following these tips can increase your chances of winning more business and building long-term customer relationships.

#1 Research your prospects

Before reaching out to a potential customer, it’s essential to research their company and industry to understand their pain points, challenges and goals. This will help you tailor your sales pitch to their specific needs.

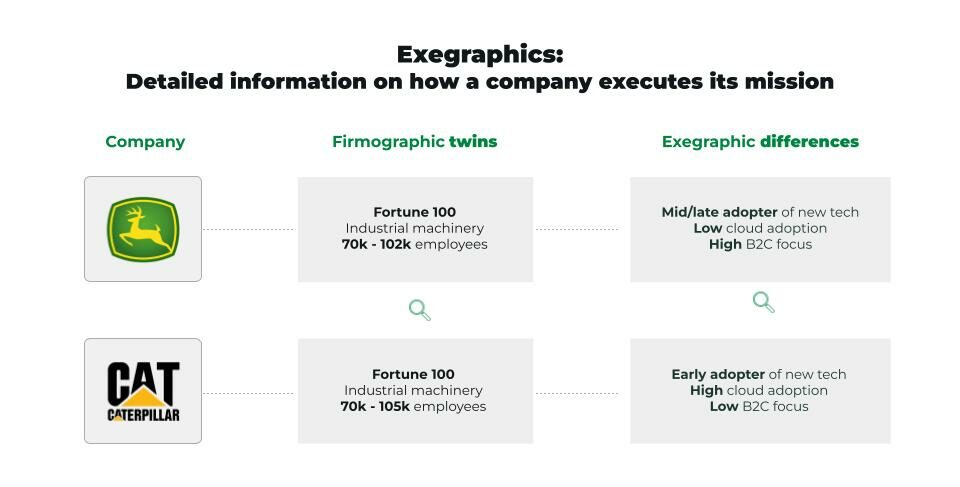

For example, with a platform like Rev, you can look at your best customers’ exegraphics (data on how companies operate and behave) to find prospects at companies that have similar characteristics. Then, you can use that information to craft a more targeted outreach message.

#2 Develop a strong value proposition

To win sales opportunities, you must have a clear and compelling value proposition demonstrating how your product or service can solve your prospect’s problems and provide value to their business.

For example, if you’re targeting companies in the healthcare industry, you might offer a solution that helps reduce costs or improve patient outcomes. But to stand out among competitors, you need to go beyond just explaining the features of your product.

So, you might strengthen your value proposition by highlighting your customer success stories, case studies and other evidence-based benefits demonstrating your solution’s impact.

#3 Build rapport with your prospects

Building a rapport with your prospects is critical for winning their trust and confidence. Your sales reps can do this by being authentic, empathetic and attentive to their needs.

Let’s imagine you’re talking to a potential customer about their financial reporting software. Instead of trying to sell them your solution, you can start by asking questions about their business and current challenges.

Showing genuine interest in understanding their needs and providing helpful advice can make them much more likely to move forward with you.

#4 Identify decision-makers and influencers

It’s essential to identify the key decision-makers and influencers in your prospect’s organization and tailor your sales pitch to their specific needs and interests. If you don’t, you could attempt to sell to the wrong person and lose valuable opportunities.

So, how do you identify key decision-makers? To start, look for names and contact information in press releases, organizational charts, LinkedIn and other professional sources. Then, once you’ve identified the decision-makers and influencers, study their backgrounds and interests to tailor your sales pitch to them specifically.

#5 Provide excellent customer service

Providing excellent customer service throughout the sales process can help you win sales opportunities and prevent lost business. This includes being responsive, transparent and attentive to your prospect’s needs.

For example, if a customer has a question, be sure to answer promptly and provide helpful solutions. You should also keep an open line of communication with your customer and stay up to date on the latest industry trends and developments.

Your customer service should extend beyond just the sales process as well. Even if you lose the sale, thank the prospect for their time and consider asking them for feedback.

#6 Follow up regularly

Regular follow up helps keep your business top of mind and demonstrate your commitment to their success. This proactive communication also helps to build relationships and trust, which can make all the difference.

Some general tips for follow-up include:

- Make sure communication is personalized and tailored to the customer’s needs.

- Use automation tools and software to help streamline follow-up and make sure it gets done promptly.

- Keep track of who you’ve contacted and when so you don’t annoy prospects by over-contacting.

For more tips, check out our article on 11 of the best practices for lead follow-up.

#7 Stay up-to-date on industry trends

Staying up-to-date on industry trends and developments can help you anticipate your prospect’s needs and tailor your sales pitch accordingly. Think about it. How can you be prepared for questions and objections if you don’t know what is happening in your industry?

One way to stay on top of your industry news is to subscribe to relevant blogs, newsletters and websites. Then, set aside some time each week to read up on the latest developments in your industry. This will help you better answer any questions or address any objections that come up during a sales call.

Final thoughts

A win/loss analysis gives you the insight and data needed to optimize your sales process, uncover lost opportunities and increase customer satisfaction. With it, you can make more informed decisions about how and where to focus your efforts for maximum success.

If you want to improve your overall win rate, start by ensuring you’re targeting the right leads and prospects. How? By using exegraphic data to refine your ideal customer profile to reflect the characteristics and behaviors of your best customers. That way, you can develop more targeted outreach and increase your chances of success.

Want to see the power of exegraphics for yourself? Contact us, and we’ll give you a free audit of your best customers and a list of companies that operate and behave just like them.