You may think revenue operations (RevOps) sounds like just another buzzword. But it’s actually given a name to a function that’s been needed in the data-driven B2B world for a LONG time.

Because for the B2B businesses that have a RevOps team, recent reports show they’ve benefited from a 100-200% increase in digital marketing ROI, a 10-20% increase in sales productivity and a 71% improvement in stock performance.

So, if RevOps is the new secret ingredient for consistent revenue growth and efficiency—you’re right to want to know how your business can implement its own RevOps function. In this case, you’ve come to the right place!

In this guide, we’ll give you an in-depth overview of revenue operations and why it’s become an increasingly important focus for B2B companies of all sizes and industries. Specifically, we’ll be discussing topics and questions like:

- What is revenue operations? And how is it different from other operations teams?

- What exactly do RevOps teams do? What are their goals, metrics and core responsibilities?

- Signs your organization would benefit from a RevOps team.

- Should you build a RevOps team by recruiting new talent or reassigning responsibilities among existing employees?

- How to build a comprehensive revenue operations strategy.

- Resources for learning more about RevOps through online certification programs, podcasts and professional communities.

A lot to cover? Absolutely. But if your business wants a smooth transition to revenue operations, this guide will be a valuable companion. So, get comfortable, and let’s begin!

What is revenue operations (RevOps)?

Revenue operations is a team or function within your organization that focuses on optimizing revenue growth by aligning the goals and strategies of sales, marketing and customer success teams.

Leveraging data and technology, revenue operations teams create and implement roadmaps to enable those go-to-market teams to work collaboratively toward achieving predictable revenue from new and existing customers.

What do RevOps teams do?

RevOps teams are responsible for analyzing the customer experience and identifying gaps that cause existing customers to churn and potential new customers (aka leads) to fall through the cracks.

RevOps then works with go-to-market teams to systematically address those gaps, eliminate redundancies in revenue-generating processes and align revenue goals across all stages of the customer journey.

As they work towards those goals, some specific task and RevOps best practices include:

- Identifying the core characteristics of a company’s ideal customer profile (ICP) for better targeting and lead generation

- Communicating with stakeholders across the organization to ensure alignment of revenue strategies and goals

- Leveraging key data points to improve revenue forecasting, including measuring revenue performance metrics such as conversion rates and customer lifetime value

- Developing strategies to increase revenue through upsells and cross-sells, including optimizing pricing models and empowering customer success teams to contribute to revenue growth

- Providing revenue insights and analysis to support strategic decision-making across all go-to-market teams

- Analyzing customer data and revenue trends to identify areas of opportunity and risk, such as churn and lost revenue

- Developing a lean and efficient tech stack so that all teams have consistent, reliable access to the same revenue data and performance metrics

How is revenue operations different from sales operations?

At its core, RevOps focuses on driving revenue growth through data-driven processes and activities. These activities include managing pipelines, optimizing revenue generation strategies based on real-time data insights and tracking revenue performance metrics.

In contrast, sales operations (Sales Ops) teams typically focus more on the operational aspects of selling, such as lead management, pipeline development and customer relationship management.

That being said, RevOps teams should work closely with Sales Ops teams to ensure that sales teams are effectively using revenue data from marketing and customer success teams to inform the prioritization of accounts and lead generation strategies.

How is revenue operations different from marketing operations?

Marketing Operations (MOps) teams focus primarily on marketing activities such as lead generation, demand generation, content creation and developing deep insights into a company’s ideal buyer.

RevOps teams support MOps by developing strategies to optimize the effectiveness of those marketing activities and bring revenue generation to the forefront of marketing strategies. For example, the RevOps team might work with MOps to develop a lead-scoring framework, which helps the marketing team prioritize leads based on revenue potential.

How is revenue operations different from business operations?

Business operations is another team that helps to drive revenue generation in a company. But its focus is more on the day-to-day tasks and processes needed to keep an organization running smoothly.

For example, business operations teams may manage budgets and expenses, improve internal communication and optimize revenue generation through marketing campaigns. On the other hand, RevOps teams are specifically focused on revenue generation, leveraging data and analytics to identify growth opportunities and optimize revenue performance.

Key RevOps metrics

How do RevOps teams measure the success of their efforts? By tracking the metrics related to revenue generation, revenue retention and growth. Those metrics include:

- Customer lifetime value (CLV): The revenue your business can expect to generate from each customer over the entire time they remain subscribed to your product. By tracking CLV, RevOps teams can identify which customers are most profitable and focus their efforts on nurturing these relationships.

- Customer acquisition cost (CAC): The cost associated with acquiring new customers for your business. By tracking CAC, RevOps teams can determine how much revenue your business needs to generate from each new customer to break even.

- Sales pipeline velocity: The speed at which sales teams are closing deals. By tracking this metric, RevOps teams can determine how quickly new revenue is generated from your sales pipeline and identify potential areas for improvement.

- Customer churn rate: The percentage of customers who leave your business after a given time period. By tracking churn, RevOps teams can identify trends and work to improve revenue generation by focusing on retaining existing customers.

- Revenue retention: The total revenue generated by a business over a given time period, compared to revenue from the same period in the previous year. RevOps teams use this metric to track and identify areas where revenue growth may have slowed or stopped.

- Recurring revenue: The monthly recurring revenue (MRR) or annual recurring revenue (ARR) generated by a business from subscriptions, memberships or similar long-term revenue streams. RevOps teams use this metric to focus on customers likely to be long-term, loyal revenue sources.

- Renewals, upsells and cross-sells: The revenue-generating activities businesses pursue to increase the revenue generated from existing customers. By tracking revenue generation from renewals, upsells and cross-sells, RevOps teams can identify ways to optimize the customer experience and areas where additional revenue growth may be possible.

- Net promoter score (NPS): The percentage of customers who recommend a business’s product or service to a friend or colleague. This metric can help RevOps teams identify and address customer pain points to increase revenue and customer satisfaction.

- Sales funnel conversion rate: The percentage of revenue generation opportunities that result in closed deals. This metric can provide RevOps teams with valuable insights into how well their sales pipeline is performing.

- Sales forecasting accuracy: The degree to which a company can accurately predict how much revenue it will generate in the future. This metric can help RevOps teams identify areas where revenue generation may lag and inform go-to-marketing teams of revenue growth opportunities they might otherwise miss.

- Sales cycle time: The time it takes for the sales team to close a deal. This metric can provide RevOps teams with valuable information about how efficiently deals are progressing through the sales cycle and whether the leads entering the sales pipeline are actually a good fit for the business.

- Average deal size: The average value of deals closed by the sales team. This metric can help revenue operations teams determine the revenue potential of new opportunities and identify opportunities to increase revenue by targeting higher-value deals.

- Revenue: The total revenue generated by the sales team. This metric can help RevOps teams assess revenue performance, identify areas for growth and set revenue targets and goals.

Essential tech stack for RevOps teams

There are hundreds of B2B software platforms and tools on the market today, each with a range of features that promise to revolutionize how your business generates revenue.

But one of the goals of a RevOps team is to evaluate the tools available and simplify to only those that are truly essential to eliminate silos and get all revenue-generating teams working together seamlessly.

So, which ones are actually essential? Here are our recommendations:

- Customer relationship management (CRM) system: A CRM helps your revenue operations team keep track of all customer interactions and data, including deals won or lost, revenue earned and support tickets.

- Project management software: Project management software helps keep revenue operations teams organized and on track. It can also help manage revenue-generating projects, such as marketing campaigns or product launches.

- Data analytics tool: A data analytics tool helps RevOps teams monitor revenue performance metrics, identify trends and opportunities, and make data-driven decisions.

- Marketing automation software: Marketing automation software helps you create and manage automated campaigns based on customer data.

- Sales Development Platform: A Sales Development Platform streamlines the process of identifying new market segments, targeting accounts with a high propensity to engage, reducing churn and driving predictable revenue growth.

Your tech stack may include additional tools and software, depending on your organization. But the tools we’ve listed here will give you a solid foundation to build on.

Signs your organization is ready to transition to RevOps

Sold on the benefits of RevOps but still not sure it’s the right next step for your organization? Here are some signs that indicate your organization is ready for a transition to RevOps:

- Sales, marketing and customer success teams that are not aligned or working effectively together to minimize revenue leakage and optimize revenue opportunities

- Inconsistent revenue reporting across teams and business units, making it difficult for stakeholders to understand key revenue metrics

- Silos of revenue-related data and dispersed revenue performance information across multiple platforms and tools

- A lack of clearly defined revenue processes and revenue-focused roles within the organization

Sound familiar? If so, you’ve taken the first step in addressing these problems. Next, you’ll need a strategic approach to building a revenue operations team with the skills, experience and mindset to drive revenue performance in an increasingly competitive business landscape.

How to build a high-performing RevOps team from scratch

Should you recruit new talent to join your revenue operations team? Or should you transfer existing employees from other roles within the company? There is no one-size-fits-all answer to these questions.

That being said, you’ll typically want to build a RevOps team of existing employees if you already have the talent in-house that you can effectively reassign or cross-train for RevOps roles. This approach is a great way to tap into the expertise already available within your organization, while minimizing disruption to your business.

However, if you need new talent, you’ll need to consider recruiting to fill new RevOps roles or outsourcing. Outsourcing can be a great option if you’re looking to add specialized skills or expertise to your revenue operations function or if you’re looking to scale your revenue operations team rapidly.

RevOps team structure

Ideally, the team will have a leader responsible for overseeing and implementing revenue generation strategies and communicating with the heads of go-to-market teams and the company CEO. Generally, the person in this role will hold a title like Head of Revenue Operations or Chief Revenue Officer (CRO). The team members under the leader will work to execute revenue generation strategies, analyze revenue data and metrics, and provide insights on revenue performance.

Keys skills needed for all RevOps team members

Regardless of how you build your RevOps team, there are a few essential skills and attributes that you should look for in your candidates.

For example, RevOps professionals must have strong analytical and critical thinking skills and the ability to interpret data and use it to inform strategies. In addition, members of your RevOps teams need excellent communication skills to effectively collaborate with other departments in your organization and external stakeholders.

For more information on developing the ideal RevOps team structure, including sample job descriptions for roles like VP of RevOps, check out how to build a high-performing RevOps team.

How to develop a comprehensive revenue operations strategy

Without a strategy, revenue operations teams may struggle to tap into their full potential. To create a robust revenue operations plan, we recommend doing the following activities:

Use data to better understand the customer journey and your ICP

One of the most critical components of a revenue operations strategy is understanding your customers and their buying journey. This requires gathering data about customer behavior and preferences, which you can use to create targeted marketing campaigns and personalized product offerings.

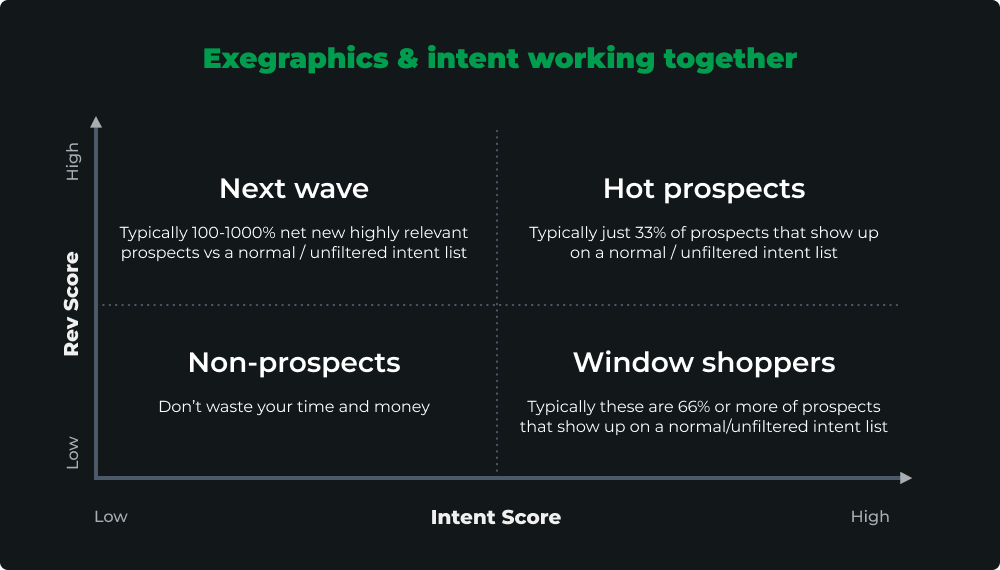

To better understand your ICP, we recommend using exegraphic data that looks at commonalities in the behavior your best customers display when they’re ready to buy. For example, you might review the data to see what type of challenges these businesses typically face when making a purchasing decision or what kind of sales and marketing messages resonate with them most.

With this information, you can create a revenue operations strategy that aligns with your ideal customer’s needs and preferences, helping you reach potential buyers more effectively and generate revenue more efficiently.

Identify roadblocks causing churn and preventing conversions

While revenue operations teams can help businesses unlock revenue potential, it’s essential to identify roadblocks that may negatively impact revenue generation. Some common roadblocks that may be causing churn and preventing conversions include:

- Poor lead quality

- Ineffective targeting of key customer segments

- Unclear pricing strategies

- Limited understanding of customer needs and pain points

Optimize and integrate the tech stack for revenue-generating teams

How many tools and platforms are go-to-market teams currently using to support revenue generation efforts? Can you optimize the tech stack so everyone can access the essential tools for the job and that these tools integrate seamlessly?

Sometimes, you can reduce churn and improve conversions by optimizing your tech stack for revenue-generating teams. For example, if all teams begin using the same data warehouse for product and revenue analytics, they can easily share insights to understand customer needs and pain points better.

Additionally, by integrating your marketing automation software with your CRM, you can ensure that every team has access to the essential data and that these tools are working in tandem to drive revenue growth.

Work with heads of go-to-market teams to improve effectiveness of strategies

Next, the head of your RevOps team will need to work with go-to-market teams to align on strategies, data and goals. These teams will play a key role in helping you to optimize revenue by providing valuable insights into your target audience, identifying revenue-driving marketing campaigns and tracking ways to prevent revenue leakage.

These teams will also need help from RevOps to ensure that revenue-generating activities are well-aligned with revenue goals and to provide them with the tools and resources they need for success.

Create a system of regular tracking and measurement of essential metrics

Your RevOps team will regularly track and measure revenue-related metrics, such as customer lifetime value and churn. Your RevOps team can achieve this by establishing key performance indicators (KPIs) for each revenue-generating activity and implementing systems that provide the necessary data for measuring progress.

Ideally, your organization will view revenue operations as an ongoing, iterative process. This means that RevOps teams should continuously evaluate the performance of revenue-generating activities and make any necessary adjustments.

Foster open communication and feedback to continuously optimize strategies

Speak to any RevOps professional, and they’ll tell you that revenue operations isn’t just about optimizing revenue generation—it’s also about getting the organization to work more holistically and improve collaboration for maximum efficiency.

This can be accomplished through frequent communication and feedback between revenue-generating teams where each team considers questions like:

- How does our work contribute to other teams’ revenue strategies and targets?

- Is there any data, tool or process that could help our team’s revenue generation efforts work more efficiently?

- What roadblocks or bottlenecks are we encountering that could be prevented at earlier stages of the customer journey?

By establishing clear goals and expectations, creating feedback loops to monitor performance and encouraging open communication, RevOps teams can maximize revenue growth across the organization.

Resources to learn more about RevOps

RevOps is still a relatively new concept in the business world. Still, there are several resources available to help you learn more! Here are some additional resources to dive deeper into RevOps:

Revenue operations training and certification courses

Revenue operations podcasts

Revenue operations online communities

Final thoughts

Whether you’re looking to implement RevOps for the first time or are looking to improve your existing revenue operations strategy, we hope this guide has helped.

Specifically, we hope it’s helped you better understand revenue operations, the benefits it can bring to your business and how to start building a comprehensive strategy to maximize revenue growth.

Want to get the most out of your RevOps strategy? Start by using exegraphic data to develop a deep understanding of your ICP to ensure you’re prioritizing the accounts with the highest propensity to engage with your business.

Contact us for a free ICP audit—and get a peek at the exegraphic data behind your best customers.